The Bonneville Power Administration (BPA) was created by the federal government in 1937 to market and transmit the electricity generated by the 31 dams on the Columbia River and it’s tributaries, as well as the Hanford nuclear power plant in Washington. Under the 1980 Northwest Power Act, they are responsible for recovering hydro-power effected populations using least cost alternatives. To address endangered salmon and steelhead runs in the Columbia and Snake Rivers, they invest in a Fish and Wildlife Program. As the hydro-system has aged maintenance costs have risen. As fish decline towards extinction, and Fish and Wildlife costs have risen. BPA has had to raise their electricity rates and go into severe debt. Even though they are loosing money, BPA continues their campaign to justify the Snake River Dams. Let’s take a closer look.

Debt

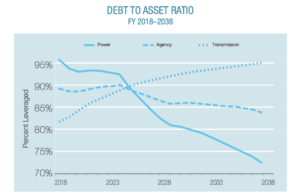

BPA’s debt is at $14.5 Billion. It must all be paid back, with interest.

“if there is an axis of nonchalance (on one end) to panic (on the other), I think it’s important that we don’t get into a panic mode, I’m not in a panic mode, but I am in a very, very, significant sense of urgency mode.” – Elliot Mainzer, BPA Administrator to NPCC, March 2018.

BPA’s debt can be attributed to two things:

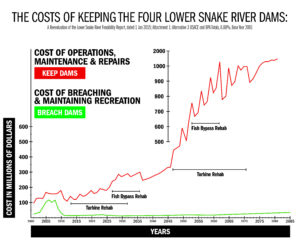

1. Increasing salmon recovery/mitigation costs 2. Increasing operation and maintenance costs on low revenue assets (such as the four lower Snake River Dams, or LSRDs).

Since the late 1990’s, more and more money has been spent on salmon recovery and mitigation. The cost for just bypass improvements on the lower Snake River Dams since 2000 is approx. $1 Billion. The total for Salmon mitigation basin-wide since 1975 is over $20 billion.

To learn about specific recovery measures being taken, see the Snake River Dams perspective.

To learn more about the hydro-system and how the Snake River Dams measure up, watch the recording of the crash course event “Understanding Energy.”

Last year (2019) BPA had to borrow 429 Million from the federal government to cover costs after spending over a billion on fish mitigation and recovery in a single year. Not one run has recovered in over 20 years. 2020 is already showing near record low Chinook returns. At this rate salmon and BPA are at risk of extinction.

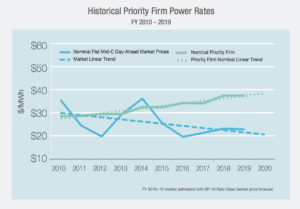

BPA financial statements show their current electricity rates will allow them to repay debts on time (~35 years for transmission investments and ~50 years for generation investments). Their strategy includes continuing to raise rates, protracting maintenance (decreases reliability) and continued borrowing from the treasury and other sources. For example, they refinance their debt by borrowing from Energy Northwest, another electricity vendor, to repay their U.S. treasury debt. This debt, totaling 227 million, is repaid with a smaller interest rate. None of these strategies will quickly recover BPAs finances or secure a reliable hydro-system for the future.

Debt burdens ratepayers & taxpayers not just in Washington and Oregon, but nationwide. Twenty-two percent of fish mitigation and recovery costs are paid for by federal taxpayers as a credit from the US Treasury. Under the current trajectory, BPA will increase fish & wildlife costs, raise rates, impose sur-charges and drive away customers – only causing rates to increase more.

If BPA does not abandon losing assets such as the LSRDs, they will likely never recover. Exposing this debt is critical to convincing lead agencies that dam breaching is the right solution.

Supporting Documents:

More BPA Documents & Data: